Life Insurance Planning: Exploring Wealth Protection and Tax Strategies

Comprehensive planning for your family’s financial security considerations.

Life insurance involves more than just replacing your income if something happens to you—though that may be important. When structured appropriately, life insurance may serve as a tool for tax-efficient wealth transfer, estate planning, business succession, and retirement income supplementation.

At Saltiel Wealth Management in Sarasota, Florida, we provide guidance on life insurance strategies for high-income professionals, small business owners, retirees, and high-net-worth families.

Our boutique practice operates from a home-based office, helping us manage overhead so we can focus on understanding your individual situation and exploring life insurance strategies that may integrate with your overall financial plan, tax planning goals, and wealth management objectives.

Whether you’re a high-income professional working to protect your family’s lifestyle, a business owner considering succession plans, a retiree exploring estate transfer options, or a high-net-worth individual seeking tax strategies, we’ll help you understand how life insurance might serve your specific goals.

Five Key Ways Life Insurance May Enhance Your Financial Planning

Life insurance strategies that may provide more than basic death benefit coverage.

1. Financial Protection That May Replace Your Economic Value

Working to help ensure your family can maintain their lifestyle.

If you’re the primary breadwinner, your ability to earn income may represent significant value over your lifetime. Life insurance may help ensure that if something happens to you, your family can maintain their lifestyle, pay off debts, fund children’s education, and work toward their financial future.

For high-income professionals, this involves calculating not just current expenses, but future goals like college funding and retirement. For business owners, it may include protecting both personal family needs and business obligations.

2. Tax Planning Considerations Beyond Basic Coverage

Exploring life insurance as part of comprehensive tax planning.

Death benefits are generally income-tax-free to beneficiaries—a potential advantage for high-net-worth families. Permanent life insurance may offer tax-deferred cash value growth that can potentially be accessed through loans when structured appropriately.

For high-net-worth families, life insurance may be placed in Irrevocable Life Insurance Trusts (ILITs) to potentially remove death benefits from your taxable estate, which may help with estate tax planning. This strategy may be valuable when integrated with your other wealth management and investment approaches.

Important: Tax benefits depend on individual circumstances and current tax law, which may change. Consult qualified tax professionals.

3. Business Continuity and Succession Planning Considerations

Helping ensure your business may survive and thrive without you.

If you’re a small business owner, life insurance may fund buy-sell agreements, potentially helping your business partners purchase your ownership interest from your family at fair market value. This may provide your family with liquidity while giving your partners control of the business.

Key person insurance may also help your business address the financial impact of losing a crucial employee or owner, potentially providing funds to recruit replacements, cover lost revenue, and maintain operations during transition.

4. Estate Planning Integration and Wealth Transfer Strategies

Exploring tax-efficient legacy planning for future generations.

Life insurance may help equalize inheritances among children, provide liquidity for estate taxes, or fund charitable giving strategies. When integrated with your complete estate plan, life insurance may help ensure your wealth transfer goals are addressed efficiently.

For families with significant assets in illiquid investments like real estate or business interests, life insurance may provide the cash needed to pay estate taxes without requiring sales of valuable assets.

5. Cash Value Accumulation for Financial Flexibility

Building potentially tax-advantaged wealth within your life insurance policy.

Permanent life insurance policies may build cash value that grows tax-deferred and can potentially be accessed through loans or withdrawals. This may provide emergency funds, supplement retirement income, or create additional financial flexibility for opportunities or unexpected needs.

When integrated with your investment portfolio at Charles Schwab, permanent life insurance may provide diversification and tax advantages that might complement your other wealth-building strategies.

Important: Cash value growth and accessibility depend on policy performance, premium payments, and loan provisions. Loans may reduce death benefits and cash value.

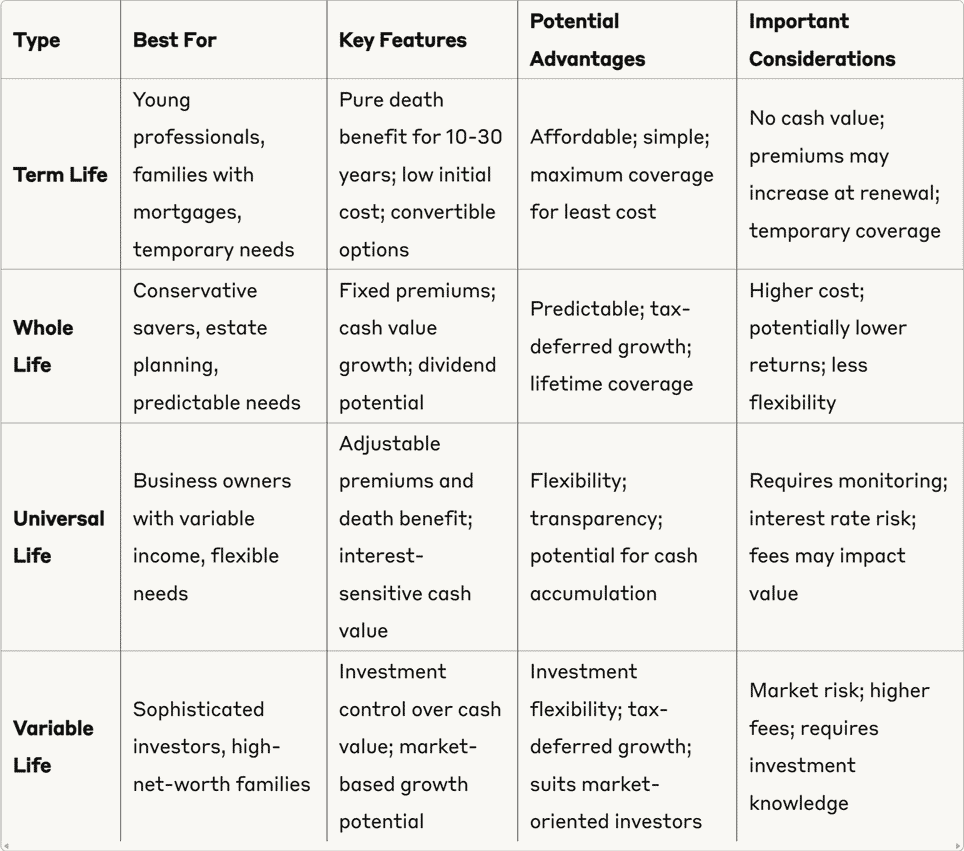

Understanding Your Life Insurance Options: A Comparison

Different types of life insurance for different situations and needs.

Which Type Might Make Sense for Your Situation?

For High-Income Professionals: Term life often provides substantial coverage during peak earning and spending years. As your wealth accumulates and tax planning becomes more important, converting to or adding permanent coverage may provide tax advantages.

For Small Business Owners: Universal life’s flexibility may work well with variable business income. You may pay higher premiums in good years and reduce them when cash flow is tight, while maintaining coverage for business succession needs.

For Retirees and High-Net-Worth Families: Whole life may provide predictable, conservative growth with guaranteed benefits, while variable life allows more investment-oriented strategies for those comfortable with market risk.

Important: All life insurance involves underwriting, medical requirements, and ongoing premium obligations. Policy performance depends on many factors including health, age, and policy management.

Our Approach to Life Insurance Planning

Your life insurance should work to serve your goals.

Comprehensive Needs Analysis

Understanding what you’re trying to accomplish.

We start by understanding your complete financial picture: your income, assets, debts, goals, and concerns. Are you protecting young children? Planning for business succession? Exploring estate tax strategies? The appropriate life insurance strategy depends on your specific situation and objectives.

Product Comparison

Exploring the market for suitable options.

We work with multiple insurance carriers to explore competitive options that may fit your needs and budget. We’ll explain the considerations of each recommendation, including costs, features, and how each option may serve your goals.

Important: Life insurance product sales may generate commissions, which we will fully disclose.

Tax Strategy Integration

Coordinating your life insurance with your complete tax plan.

Life insurance should be coordinated with your overall financial planning. We work to integrate your life insurance strategy with your tax planning, investment management, and estate planning to help ensure everything may work together efficiently. This includes considerations like premium funding, policy ownership structures, and beneficiary planning.

Ongoing Policy Management

Life insurance strategies may need ongoing attention.

Your life insurance needs may change as your life evolves. We provide ongoing monitoring to help ensure your coverage remains adequate and cost-effective. For permanent policies, this includes cash value performance tracking and optimization recommendations.

Important: Policy performance depends on premium payments, policy charges, and underlying investments (for variable products).

Frequently Asked Questions About Life Insurance

How does life insurance support tax planning? Permanent life insurance may offer several tax advantages: death benefits are generally income-tax-free, cash value may grow tax-deferred, and you might access cash value through loans when structured appropriately. For high-net-worth families, life insurance in trusts may provide estate tax benefits.

Important: Tax benefits depend on individual circumstances and current tax law, which may change.

Is life insurance necessary if I already have substantial investments? Life insurance may serve different purposes than investments. While your investment portfolio grows wealth, life insurance may provide immediate liquidity that isn’t subject to market volatility. It may be particularly valuable for estate liquidity, business succession, or protecting dependents during your wealth-accumulation years.

How does your life insurance guidance work? We work with multiple carriers to explore competitive options, and we explain costs, benefits, and alternatives so you can make informed decisions.

Important: Life insurance product sales may generate commissions, which we will fully disclose.

How do I know if I need more life insurance coverage? We’ll analyze your current coverage against your actual needs, considering your income, debts, goals, and existing assets. Many people are either over-insured (paying for unnecessary coverage) or under-insured (leaving gaps in protection). A comprehensive analysis may help identify appropriate coverage for your situation.

Can life insurance help with business succession planning? Life insurance may fund buy-sell agreements, potentially providing liquidity for surviving partners to purchase a deceased owner’s interest at fair market value. It may also provide key person coverage to help businesses address the loss of crucial employees or owners.

How does life insurance coordinate with my other investments at Charles Schwab? Life insurance may provide diversification and tax advantages that complement your investment portfolio. While your investments may focus on growth, life insurance may provide guaranteed benefits and tax-advantaged cash accumulation that might enhance your overall wealth management strategy.

How does working with you differ from buying life insurance online or through other agents? We provide analysis across multiple carriers and work to integrate your life insurance with your complete financial plan. Online purchases may lack personalized analysis, while some agents can only offer products from one company.

Life Insurance Integration With Your Complete Financial Strategy

Life insurance strategies may work more effectively when coordinated with your other financial goals.

Estate Planning Coordination

Working with your estate planning attorney to structure ownership, beneficiaries, and trust arrangements that may optimize tax benefits and help achieve your legacy goals.

Investment Portfolio Complement

Coordinating with your Charles Schwab investment management to help ensure your life insurance provides appropriate diversification and tax advantages without duplicating other strategies.

Tax Planning Integration

Aligning premium payments, cash value accumulation, and benefit structures with your overall tax planning strategy to potentially help optimize after-tax wealth.

Business Planning Support

For business owners, integrating life insurance with succession planning, key person protection, and employee benefit strategies to support business objectives.

Retirement Planning Enhancement

Using cash value accumulation and tax-advantaged access features to potentially supplement retirement income and provide additional financial flexibility.

Ready to Explore Life Insurance for Your Family’s Financial Planning?

Let’s explore a life insurance strategy that may serve your needs.

Your family’s financial planning is important. Whether you need cost-effective term coverage to protect dependents, permanent insurance for estate planning, or business succession strategies, appropriate life insurance may provide peace of mind and financial benefits.

We’ll help you understand your options, explore competitive coverage from highly-rated carriers, and work to integrate your life insurance strategy with your complete financial plan.

Schedule a complimentary life insurance review today. We’ll analyze your current coverage, discuss your goals, and explore how appropriate life insurance strategies might enhance your family’s financial foundation and your overall wealth management objectives.

Important Disclosures

No Guarantee of Results: No life insurance strategy can guarantee specific outcomes. Life insurance involves underwriting requirements, premium obligations, and policy conditions that may affect coverage and benefits.

Educational Purpose Only: This information is for educational purposes only and does not constitute insurance, investment, tax, legal, or financial advice. No content should be construed as a recommendation to purchase any specific life insurance product.

Life Insurance Product Risks and Considerations: All life insurance products have limitations, exclusions, and conditions that may affect coverage. Life insurance involves medical underwriting and may not be available to all applicants. Premiums must be paid as scheduled or policies may lapse. Cash value growth depends on policy performance, premium payments, and policy charges. Loans and withdrawals may reduce death benefits and cash value.

Variable Life Insurance Risks: Variable life insurance involves investment risk and cash value may fluctuate based on underlying investment performance. You may lose money, including amounts paid in premiums. Variable life insurance has higher fees than term life insurance and requires ongoing investment management decisions.

Universal Life Insurance Risks: Universal life insurance requires ongoing monitoring and may require increased premium payments if policy charges exceed expectations. Interest rate changes may affect cash value growth. Insufficient premium payments may cause policy to lapse.

Tax Considerations: Tax benefits of life insurance depend on individual circumstances, current tax law, and proper policy structure and management. Tax laws may change, potentially affecting the benefits described. Life insurance death benefits are generally income-tax-free but may be subject to estate taxes. Cash value access through loans may have tax implications if policy lapses. Consult with qualified tax professionals regarding your specific tax situation.

Commission Disclosure: Life insurance product sales generate commissions and other compensation. We will provide full disclosure of all compensation arrangements before any product purchase. This compensation may create conflicts of interest, which we work to manage in your best interest as a fiduciary advisor.

Underwriting and Health Requirements: Life insurance coverage is subject to underwriting approval based on health, lifestyle, financial, and other factors. Coverage may not be available to all applicants. Medical examinations, health records, and financial documentation may be required. Premiums are based on underwriting classification and may be higher than illustrated.

Policy Performance: Illustrated policy values are not guaranteed and are based on assumptions that may not prove accurate. Actual policy performance may be significantly different from illustrations. Regular monitoring and potential premium adjustments may be required.

Individual Suitability: Strategies that may be appropriate for one person may not be suitable for another. Individual circumstances including health, age, income, family situation, risk tolerance, and financial objectives significantly affect the suitability of different life insurance approaches.

Professional Consultation Required: Before implementing any life insurance strategies, consult with qualified insurance professionals, tax advisors, estate planning attorneys, and other experts familiar with your specific circumstances.

State Licensing Limitations: Life insurance products and services are provided only in states where properly licensed. Product availability varies by state and carrier.

Estate and Trust Considerations: Advanced life insurance strategies involving trusts and estate planning require coordination with qualified legal professionals. Trust structures have ongoing administrative requirements and costs. Estate and gift tax laws may change.